Content

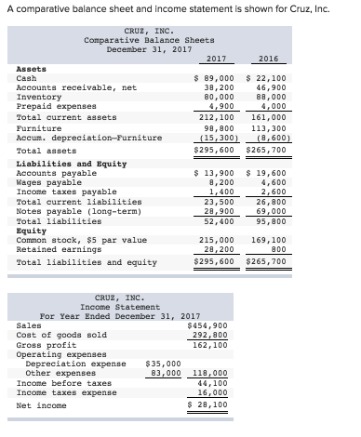

An entrepreneur might keep a lawyer on retainer to help review contracts and protect the best interest of the business. A business owner might use a bookkeeper to balance the ledgers each month. The services of accountants, tax preparers, attorneys, and other professionals are valuable, but they don’t come cheap. Avoid using your personal credit card for business expenses, as it can be hard to differentiate which expenses are which—especially if you wait until tax time.

Some utility costs may be static, like your monthly internet bill, while others will fluctuate, like your electricity costs. As with other expenses, the situation is approached differently if some of the costs were for the personal side of your life. You’ll need to partner with an expert to ensure you handle it correctly. Here, https://kelleysbookkeeping.com/ you can categorize the premiums you pay for general liability, professional indemnity, liability insurance, disability insurance, workers’ compensation insurance, and more. This includes the costs of health permits, industry-required certifications, and occupational licenses that fit the market to which your company caters.

Specific expense categories

Housing and domestic assistance programs are examples of the many employee benefit programs available. Campaign contributions – Donations given to politicians, political parties, or election campaigns by people, groups, and businesses. Payouts for lobbying efforts – Lobbying expenditures are monetary resources private entities use to persuade public officials to adopt their policy positions. Anything from investing in billboard space to staffing up with lobbyists falls under this category. Invoicing for iOS Experience hassle-free invoicing on your iPhone and iPad by downloading the Moon Invoice app for iOS.

- Expense categories provide a variety of benefits for small business owners.

- As you can see, effective expense management has an outsize impact on your business.

- Buying or selling business assets affects a business’s financial health and its tax obligations.

- This includes the employee healthcare plan, funds you contribute to staff 401 retirement accounts, and perks like company gym memberships or compensation for parking or public transit fees.

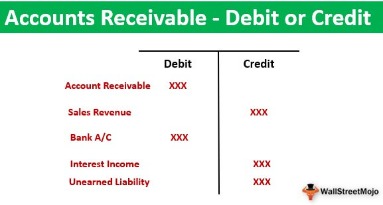

The cost of cellphones and internet use is deductible according to the percentage of their use for business. Landline phones generally aren’t tax deductible unless they’re a second landline for business use only. Traditionally, businesses would keep track of their expenses and income by hiring an accountant or recording their transactions manually. Nowadays, however, there are several free or low-cost software programs and apps to make tracking easier and more convenient. Include the cost of shipping, such as postage or shipping costs with other carriers. Can be used as an all-in-one control center from where you can track, manage and control your small business expenses list.

Not everything is deductible

Maintenance and repairs for items that are essential to the operation of the business. This includes repairs on company vehicles, gas expenses, and the repair of machines or equipment that is essential to the well-being of the business. WellyBox is the ultimate business receipt management solution, powered by the cutting-edge technology of ChatGPT and OCR.

Accurate records are essential to getting your categories right. When you go through your bank transactions, get the details of any spending, and assign it to a business category in your accounting software. For example, say you’re putting 250 miles per week on your private vehicle to get products out to customers.

Home Office

For sole proprietorships or partnerships, the criteria for eligibility include moving at least 50 miles and working at least 39 weeks in that location after the move. One of the first issues to consider when learning how to categorize expenses and assets is the definition of a business expense. A business How To Categorize Expenses For Small Business expense is what a company spends or how much cost it incurs as part of its efforts to generate revenue. The IRS has defined business expenses as “the cost of carrying on a trade or business,” going on to say that these expenses are usually deductible if the business operates to make a profit.

Packaging, posting and shipping costs can be deducted from your taxes, as they’re part of your business operations. Here are some common expense categories that most businesses will deal with at some point. Curious how Navan can make managing the above expense categories easier?

Use this category for making payments into a business retirement plan, like a 401. If your business provides you with health insurance and pays premiums on your behalf, be sure to categorize them appropriately. Yes, you can deduct business-related expenses even if you take the standard deduction. If you have a home office and itemize your taxes, you may be able to deduct some of the taxes you pay.